Quick Commerce vs E-commerce: What Works for D2C Brands?

The New Retail Battleground for D2C Brands

India’s consumer market is evolving rapidly, and at the center of this shift is the debate of quick commerce vs e-commerce. While traditional ecommerce in India has already transformed how people shop for everything from fashion to electronics, the rise of quick commerce India has introduced a new level of convenience built on ultra-fast delivery. For Direct-to-Consumer (D2C) brands, understanding where to play and how to balance these two models is critical for growth and sustainability.

Understanding the Two Models: Quick Commerce vs E-commerce

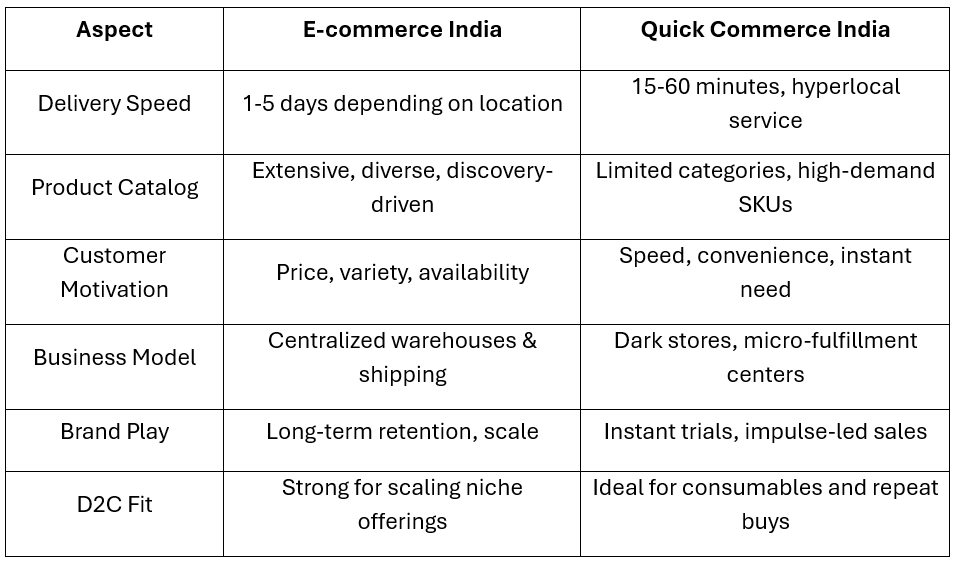

• E-commerce refers to the online buying and selling of goods, typically with delivery timelines spanning one to several days. It thrives on variety, discovery, and competitive pricing for consumers.

• Quick Commerce is a subset of e-commerce focused on speed, typically fulfilling orders within 15 to 60 minutes. It is powered by hyperlocal warehouses, limited product catalogs, and logistics optimization.

While both models serve online consumers, their unit economics, customer expectations, and brand strategies differ significantly. For D2C brands, the question is not whether one model is better but how the two can complement each other.

• Quick Commerce is a subset of e-commerce focused on speed, typically fulfilling orders within 15 to 60 minutes. It is powered by hyperlocal warehouses, limited product catalogs, and logistics optimization.

While both models serve online consumers, their unit economics, customer expectations, and brand strategies differ significantly. For D2C brands, the question is not whether one model is better but how the two can complement each other.

Growth of E-Commerce in India

E-commerce has been the backbone of digital retail for over a decade. With players like Amazon, Flipkart, Myntra, and countless D2C websites, Indian shoppers have embraced online buying because it offers:

• Variety and scale: Vast product catalogs across categories from fashion to furniture.

• Discovery-driven shopping: Customers browse, compare, and purchase at leisure.

• Nationwide reach: Ability to serve both metro and non-metro buyers.

In 2025, ecommerce in India is expected to cross USD 200 billion, driven by tier-two and tier-three city adoption. D2C clothing, skincare, and electronics brands rely heavily on established e-commerce channels for scale.

• Variety and scale: Vast product catalogs across categories from fashion to furniture.

• Discovery-driven shopping: Customers browse, compare, and purchase at leisure.

• Nationwide reach: Ability to serve both metro and non-metro buyers.

In 2025, ecommerce in India is expected to cross USD 200 billion, driven by tier-two and tier-three city adoption. D2C clothing, skincare, and electronics brands rely heavily on established e-commerce channels for scale.

The Rise of Quick Commerce in India

The popularity of quick commerce India is fueled by changing lifestyles. Platforms like Blinkit, Zepto, and Swiggy Instamart have shown that speed creates stickiness. Consumers in urban areas are increasingly willing to pay for faster delivery of essentials, snacks, grooming products, and even impulse buys.

Key factors driving this surge are:

• Busy urban lifestyles and demand for instant gratification.

• Younger demographics seeking convenience over price sensitivity.

• Rising disposable incomes that normalize premium services.

• Expansion of micro-warehousing and AI-driven route optimization.

For D2C brands, quick commerce opens a new demand channel where speed itself is a product driver. A skincare brand promising “glow in 20 minutes” can now deliver its kits within the same timeframe, aligning marketing promises with fulfillment.

Key factors driving this surge are:

• Busy urban lifestyles and demand for instant gratification.

• Younger demographics seeking convenience over price sensitivity.

• Rising disposable incomes that normalize premium services.

• Expansion of micro-warehousing and AI-driven route optimization.

For D2C brands, quick commerce opens a new demand channel where speed itself is a product driver. A skincare brand promising “glow in 20 minutes” can now deliver its kits within the same timeframe, aligning marketing promises with fulfillment.

What Works for D2C Brands?

When to Leverage E-commerce

• D2C categories like fashion, home décor, electronics, and luxury products benefit most from e-commerce due to higher involvement, browsing time, and variety-driven buying.

• It allows brands to build full-funnel engagement with customers: awareness, trials, and repeat purchases via loyalty programs and customized storefronts.

• Tools like Google Analytics on a SmartBiz website make it possible to refine digital marketing campaigns and optimize acquisition funnels.

• It allows brands to build full-funnel engagement with customers: awareness, trials, and repeat purchases via loyalty programs and customized storefronts.

• Tools like Google Analytics on a SmartBiz website make it possible to refine digital marketing campaigns and optimize acquisition funnels.

When to Leverage Quick Commerce

• Brands dealing in personal care, packaged foods, beverages, and consumables should explore quick commerce integrations.

• The model helps drive impulse purchases - for example, a D2C beverage startup can drive sales during peak evening hours by appearing on Blinkit or Zepto.

• Return Analytics tools integrated with digital platforms can provide clarity on consumer buying motivations, helping brands refine their quick commerce offerings.

• The model helps drive impulse purchases - for example, a D2C beverage startup can drive sales during peak evening hours by appearing on Blinkit or Zepto.

• Return Analytics tools integrated with digital platforms can provide clarity on consumer buying motivations, helping brands refine their quick commerce offerings.

Hybrid Strategy for Maximum Growth

The future for Indian D2C brands is not a binary choice of quick commerce vs e-commerce. A hybrid approach works best where:

• E-commerce serves as the brand’s flagship channel for depth, storytelling, and scaling nationwide.

• Quick commerce acts as an accelerator for urban penetration, festival spikes, and high-frequency product categories.

• E-commerce serves as the brand’s flagship channel for depth, storytelling, and scaling nationwide.

• Quick commerce acts as an accelerator for urban penetration, festival spikes, and high-frequency product categories.

Case Study: How D2C Brands Balance Both

• mCaffeine (Personal Care): Primarily a D2C brand through its website and marketplaces, it also appears on quick commerce platforms for impulse-driven products like face masks and scrubs.

• Slurrp Farm (Snacking & Health Foods): Built its initial traction online but now uses quick commerce to capture evening snacking demand, especially among young urban parents.

• Wingreens World (Condiments): Uses e-commerce for B2C packs but partners with quick commerce for single-use and trial-sized SKUs.

These examples show that successful brands design product portfolios strategically to suit the distribution ecosystem.

• Slurrp Farm (Snacking & Health Foods): Built its initial traction online but now uses quick commerce to capture evening snacking demand, especially among young urban parents.

• Wingreens World (Condiments): Uses e-commerce for B2C packs but partners with quick commerce for single-use and trial-sized SKUs.

These examples show that successful brands design product portfolios strategically to suit the distribution ecosystem.

Action Plan for D2C Entrepreneurs

If you are an entrepreneur exploring quick commerce vs e-commerce in India, consider these steps:

1. Study your category fit: Is your product high-frequency, impulse-driven, or discovery-led?

2. Align inventory management: Quick commerce requires micro-warehousing, while e-commerce needs centralized warehouses.

3. Leverage analytics: Use insights from tools like Google Analytics to identify what resonates online, and replicate success in short-cycle channels.

4. Build resilience: Do not depend solely on one channel; diversify for long-term growth.

1. Study your category fit: Is your product high-frequency, impulse-driven, or discovery-led?

2. Align inventory management: Quick commerce requires micro-warehousing, while e-commerce needs centralized warehouses.

3. Leverage analytics: Use insights from tools like Google Analytics to identify what resonates online, and replicate success in short-cycle channels.

4. Build resilience: Do not depend solely on one channel; diversify for long-term growth.

The Future of D2C Growth in India

As India’s consumer expectations rise, quick commerce will coexist with ecommerce India to create a multi-layered ecosystem. Quick commerce will dominate immediacy-based needs, while e-commerce will continue to thrive for considered purchases. D2C brands that adapt early to this hybrid model will not only win in metros but also build scalable operations for the long term.

SmartBiz by Amazon provides the backbone that D2C entrepreneurs need across both models. With catalog synchronization, delivery management, and data-driven insights, SmartBiz helps you streamline e-commerce operations while preparing for quick commerce integration.

SmartBiz by Amazon provides the backbone that D2C entrepreneurs need across both models. With catalog synchronization, delivery management, and data-driven insights, SmartBiz helps you streamline e-commerce operations while preparing for quick commerce integration.

COMPANY

Built in

© 2023 Amazon.com, Inc. or its affiliates. All rights reserved